Disclaimer

You are now leaving the Independent Bank website.

Linked web pages are not under the control of Independent Bank, its affiliates or subsidiaries. Be aware the privacy policy of the site to which you are going may differ from that of Independent Bank. Independent Bank provides external links as a convenience and is not responsible for the content, accessibility, or security of any linked web page.

Click “OK” to continue or “Cancel” to go back

Ok CancelDisclaimer

You are now leaving the Independent Bank website.

Linked web pages are not under the control of Independent Bank, its affiliates or subsidiaries. Be aware the privacy policy of the site to which you are going may differ from that of Independent Bank. Independent Bank provides external links as a convenience and is not responsible for the content, accessibility, or security of any linked web page.

Click “OK” to continue or “Cancel” to go back

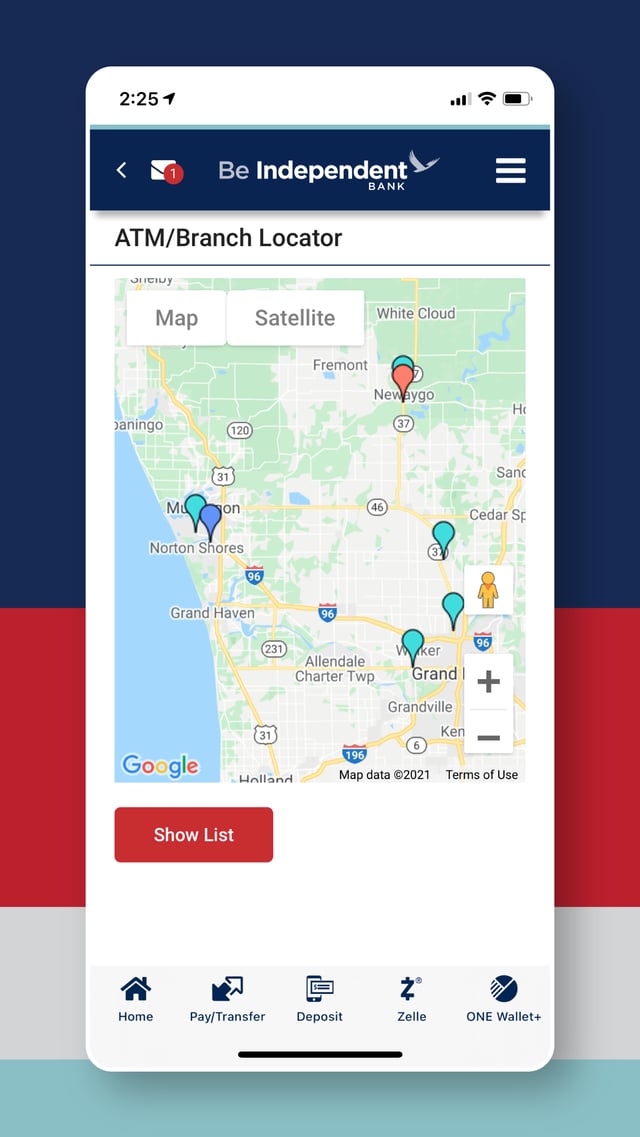

Location

Ann Arbor Mortgage Loan Center | Independent Bank

Mortgage & Loan CenterContact Information

A: 3025 Boardwalk Drive Suite 260 Ann Arbor MI 48108

P: 734-545-7124

Auburn | Independent Bank

Branch LocationContact Information

A: 1004 W. Midland Road Auburn, MI 48611

P: 989.662.4403

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 6:00 pm

Saturday CLOSED

Bad Axe | Independent Bank

Branch LocationContact Information

A: 655 N. Port Crescent Bad Axe, MI 48413

P: 989.269.6471

Office

Monday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Drive-Up

Monday - Thursday 8:30 am - 5:00 pm

Friday 8:30 am - 6:00 pm

Saturday 9:00 am - 12:00 pm

Bay City - Euclid | Independent Bank

Branch LocationContact Information

A: 745 N. Euclid Ave. Bay City, MI 48706

P: 989.684.6021

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Sunday - closed

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 6:00 pm

Saturday 9:00 am - 12:00 pm

Sunday - closed

Bay City - Washington Ave. | Independent Bank

Branch LocationContact Information

A: 623 Washington Ave. Bay City, MI 48708

P: 989.892.3511

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 6:00 pm

Belding | Independent Bank

Branch LocationContact Information

A: 130 S. Bridge St. Belding, MI 48809

P: 616.794.0600

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Saturday CLOSED

Drive-Up

Monday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Bellevue | Independent Bank

Branch LocationContact Information

A: 111 E. Capital Ave. Bellevue, MI 49021

P: 269.763.9424

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Beverly Hills | Independent Bank

Branch LocationContact Information

A: 32800 Southfield Road Beverly Hills, MI 48025

P: 248.647.5900

Office

Monday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Drive-Up

Monday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Big Rapids | Independent Bank

Branch LocationContact Information

A: 404 Perry Ave., Suite A Big Rapids, MI 49307

P: 231.796.5865

Office

Monday - Thursday 9:00 am - 4:00 pm

Friday 9:00 am - 5:00 pm

Saturday - closed

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Brighton | Independent Bank

Branch LocationContact Information

A: 8700 N. Second St, Brighton, MI 48116

P: 810.819.8005

Schedule an appointment

Office

Monday - Friday 9:00 am - 5:00 pm

Saturday CLOSED

Drive-Up

Monday - Friday 9:00 am - 5:00 pm

Saturday CLOSED

Mortgage Loan Center - Cadillac | Independent Bank

Mortgage & Loan CenterContact Information

A: 201 N. Mitchell St., Suite 104 Cadillac, MI 49601

P: 231.942.7156

Office

Monday - Friday 9:00 am - 5:30 pm

Caro | Independent Bank

Branch LocationContact Information

A: 1111 W. Caro Road Caro, MI 48723

P: 989.673.5656

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Drive-Up

Monday - Thursday 8:30 am - 5:00 pm

Friday 8:30 am - 6:00 pm

Saturday 9:00 am - 12:00 pm

Carson City | Independent Bank

Branch LocationContact Information

A: 323 W. Main St. Carson City, MI 48811

P: 989.584.3118

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Saturday - closed

Drive-Up

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Caseville | Independent Bank

Branch LocationContact Information

A: 6727 Main St. Caseville, MI 48725

P: 989.856.2225

Office

April 1 - September 30

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

October 1 - March 31

Monday - Thursday 9:00 am - 4:00 pm

Friday 9:00 am - 4:30 pm

Drive-Up

April 1 - September 30

Monday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

October 1 - March 31

Monday - Friday 9:00 am - 4:30 pm

Saturday CLOSED

Cass City | Independent Bank

Branch LocationContact Information

A: 6241 Main St. Cass City, MI 48726

P: 989.872.2105

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Saturday - closed

Drive-Up

Monday - Thursday 8:30 am - 5:00 pm

Friday 8:30 am - 6:00 pm

Saturday 9:00 am - 12:00 pm

Cedar Springs | Independent Bank

Branch LocationContact Information

A: 4115 17 Mile Road Cedar Springs, MI 49319

P: 616.696.0050

Office

Monday - Wednesday 9:00 am - 5:00 pm

Thursday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Charlotte | Independent Bank

Branch LocationContact Information

A: 129 Lansing St. Charlotte, MI 48813

P: 517.543.4994

Office

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Drive-Up

Monday - Friday 8:30 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Contact Information

A: 19176 Hall Road Suite 150, Clinton Township, MI 48038

P: 586.327.1318

Office

Monday - Friday 8:30 am - 5:00 pm

Clio | Independent Bank

Branch LocationContact Information

A: 3500 W. Vienna Road Clio, MI 48420

P: 810.687.6710

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 5:30 pm

Saturday 9:00 am - 12:00 pm

Contact Information

A: 7389 Croton Hardy Dr. Newaygo, MI 49337

24 Hour ATM Service

Dearborn Mortgage Loan Center | Independent Bank

Mortgage & Loan CenterContact Information

A: 16030 Michigan Ave., Suite 210 Dearborn, MI 48126

P: 313.446.8670

Office

Monday - Friday 9:00 am - 5:00 pm

Detroit Mortgage Loan Center | Independent Bank

Mortgage & Loan CenterContact Information

A: 3100 Woodward Ave Suite 102, Detroit MI 48201

P: 248.952.4914

Wednesdays: 9 - 2 pm

Monday - Saturday: By Appointment Only

East Lansing | Independent Bank

Branch LocationContact Information

A: 1380 W. Lake Lansing Road East Lansing, MI 48823

P: 517.203.3800

Office

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Drive-Up

Monday - Thursday 9:00 am - 5:30 pm

Friday 9:00 am - 5:30 pm

Saturday 9:00 am - 12:00 pm

East Lansing - West Road Loan Center | Independent Bank

Mortgage & Loan CenterContact Information

A: 2900 West Road East Lansing, MI 48823

P: 517.324.7400

Office

Monday - Friday 9:00 am - 5:00 pm

Eaton Rapids | Independent Bank

Branch LocationContact Information

A: 2461 S. Michigan Road Eaton Rapids, MI 48827

P: 517.663.4108

Office

Monday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Drive-Up

Monday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Essexville | Independent Bank

Branch LocationContact Information

A: 1615 W. Center Ave. Essexville, MI 48732

P: 989.893.4563

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Saturday - closed

Sunday - closed

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 6:00 pm

Saturday 9:00 am - 12:00 pm

Sunday - closed

Fairlawn Mortgage Loan Center | Independent Bank

Mortgage & Loan CenterContact Information

A: 275 Springside Drive., Suite 101, Fairlawn, OH 44333

P: 234.815.1501

By Appointment Only

Farmington Hills | Independent Bank

Branch LocationContact Information

A: 32900 Middlebelt Road Farmington Hills, MI 48334

P: 248.539.4600

Office

Monday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Drive-Up

Monday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Grand Haven Mortgage Loan Center | Independent Bank

Mortgage & Loan CenterContact Information

A: 1014 S Beacon Blvd Grand Haven MI 49417

P: 616.836.9261

Grand Rapids - Cascade | Independent Bank

Branch LocationContact Information

A: 6750 Cascade Road SE Grand Rapids, MI 49546

P: 616.949.2189

Office

Monday - Friday 9:00 am - 4:30 pm

Saturday CLOSED

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Contact Information

A: 77 Monroe Center Ave. NW, Suite 1200 Grand Rapids, MI 49503

P: 616.458.7045

Office

Monday - Friday 8:30 am - 5:00 pm

Grand Rapids - East Beltline | Independent Bank

Branch LocationContact Information

A: 4200 E. Beltline Grand Rapids, MI 49525

P: 616.363.1207

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 5:00 pm

Saturday Closed

Grand Rapids - Monroe Center | Independent Bank

Branch LocationContact Information

A: 77 Monroe Center NW Grand Rapids, MI 49503

P: 616.458.7045

Grand Rapids - Plainfield | Independent Bank

Branch LocationContact Information

A: 3090 Plainfield NE Grand Rapids, MI 49505

P: 616.447.0900

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Saturday - closed

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Grand Rapids - Standale | Independent Bank

Branch LocationContact Information

A: 4525 Lake Michigan Dr. Walker, MI 49534

P: 616.735.2293

Office

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Grand Rapids Beltline Mortgage Loan Center | Independent Bank

Mortgage & Loan CenterContact Information

A: 4150 E Beltline Grand Rapids MI 49525

P: 616-304-2009

Grosse Pointe Woods Mortgage Loan Center | Independent Bank

Mortgage & Loan CenterContact Information

A: 20439 Mack Ave Grosse Pointe Woods MI 48236

P: 313-530-2156

Holland | Independent Bank

Branch LocationContact Information

A: 12368 Riley St, Holland, MI 49424

P: 616.344.2470

Schedule an appointment

Office

Monday - Friday 9:00 am - 4:30 pm

Saturday - By Appointment

Drive-Up

Monday - Friday 9:00 am - 5:00 pm

Saturday CLOSED

Holland Mortgage Loan Center | Independent Bank

Mortgage & Loan CenterContact Information

A: 210 Central Ave Holland MI 49423

P: 616.836.9261

Howard City | Independent Bank

Branch LocationContact Information

A: 720 W. Shaw Howard City, MI 49329

P: 231.937.4374

Office

Monday - Thursday 9:00 am - 4:00 pm

Friday 9:00 am - 5:00 pm

Saturday - closed

Drive-Up

Monday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Ionia ATM Only | Independent Bank

ATM OnlyContact Information

A: 230 W. Main St. Ionia, MI 48846

24 Hour ATM Service

Ionia - Point | Independent Bank

Branch LocationContact Information

A: 450 S. Dexter St. Ionia, MI 48846

P: 616.527.7500

Office

Monday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Drive-Up

Monday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Ionia - South | Independent Bank

ATM OnlyContact Information

A: 2551 S. State St. Ionia, MI 48846

24 Hour ATM Service

Kalamazoo Mortgage Loan Center | Independent Bank

Mortgage & Loan CenterContact Information

A: 2280 South 11th St Kalamazoo MI 49009

P: 269-569-7254

Kingston ATM Only | Independent Bank

ATM OnlyContact Information

A: 5854 State St. Kingston, MI 48741

24 Hour ATM Service

Leslie | Independent Bank

Branch LocationContact Information

A: 144 S. Main St. Leslie, MI 49251

P: 517.589.8222

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 5:30 pm

Saturday 9:00 am - 12:00 pm

Livonia | Independent Bank

Branch LocationContact Information

A: 37601 W. Five Mile Road Livonia, MI 48154

P: 734.591.4400

Office

Monday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Drive-Up

Monday - Thursday 8:30 am - 5:00 pm

Friday 8:30 am - 5:30 pm

Saturday 9:00 am - 12:00 pm

Marlette | Independent Bank

Branch LocationContact Information

A: 2593 S. Van Dyke Marlette, MI 48453

P: 989.635.3541

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Drive-Up

Monday - Thursday 8:30 am - 5:00 pm

Friday 8:30 am - 6:00 pm

Saturday 9:00 am - 12:00 pm

Mason | Independent Bank

Branch LocationContact Information

A: 190 W. Kipp Road Mason, MI 48854

P: 517.244.9361

Office

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Midland Mortgage Loan Center | Independent Bank

Mortgage & Loan CenterContact Information

A: 409 Ashman Midland , MI 48640

P: 989-486-6216

Muskegon | Independent Bank

Branch LocationContact Information

A: 3251 Henry St. Muskegon, MI 49441

P: 231.830.3999

Office

Monday - Friday 9:00 am - 4:30 pm

Saturday CLOSED

Drive-Up

Monday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Newaygo | Independent Bank

Branch LocationContact Information

A: 41 N. State Rd. Newaygo, MI 49337

P: 231.652.1665

Office

Monday - Thursday 9:00 am - 4:00 pm

Friday 9:00 am - 4:00 pm

Saturday - closed

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Contact Information

A: 199 W. River Valley Newaygo, MI 49337

24 Hour ATM Service

North Branch | Independent Bank

Branch LocationContact Information

A: 4046 Huron St. North Branch, MI 48461

P: 810.688.3051

North Branch Drive-Up | Independent Bank

Drive Up ATM OnlyContact Information

A: 3765 Huron St. North Branch, MI 48461

P: 810.688.4727

Drive-Up

Monday - Thursday 8:30 am - 5:00 pm

Friday 8:30 am - 6:00 pm

Saturday 9:00 am - 12:00 pm

Okemos | Independent Bank

Branch LocationContact Information

A: 2119 Hamilton Road Okemos, MI 48864

P: 517.381.0817

Office

Monday - Friday 9:00 am - 5:00 pm

Saturday CLOSED

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 5:30 pm

Saturday CLOSED

Olivet ATM Only | Independent Bank

ATM OnlyContact Information

A: 112 S Main St, Olivet, MI 49076

24 Hour ATM Service

Pigeon ATM Only | Independent Bank

ATM OnlyContact Information

A: 7237 Nitz Street, Pigeon, MI 48755

24 Hour ATM Service

Pinconning | Independent Bank

Branch LocationContact Information

A: 408 Mable St. Pinconning, MI 48650

P: 989.879.2747

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Drive-Up

Monday - Friday 9:00 am - 5:00 pm

Saturday CLOSED

Pleasant Lake | Independent Bank

Branch LocationContact Information

A: 11628 Bunkerhill Road Pleasant Lake, MI 49272

P: 517.769.2200

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Portland | Independent Bank

Branch LocationContact Information

A: 1601 Grand River Ave. Portland, MI 48875

P: 517.647.7547

Office

Monday - Friday 9:00 am - 4:30 pm

Saturday CLOSED

Drive-Up

Monday - Friday 9:00 am - 4:30 pm

Saturday 9:00 am - 12:00 pm

Contact Information

A: 320 E Vermontville Hwy, Potterville, MI 48876

24 Hour ATM Service

Contact Information

A: 348 Main St. Rives Junction, MI 49277

24 Hour ATM Service

Rockford | Independent Bank

Branch LocationContact Information

A: 78 S. Main St. Rockford, MI 49341

P: 616.866.4471

Office

Monday - Friday 9:00 am - 4:30 pm

Saturday CLOSED

Drive-Up

Monday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Rockford Mortgage Loan Center | Independent Bank

Mortgage & Loan CenterContact Information

A: 28 N Monroe Rockford MI 49341

P: 616-304-2009

Saginaw - Center | Independent Bank

Branch LocationContact Information

A: 1445 N. Center Road Saginaw, MI 48638

P: 989.799.1673

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Saturday - closed

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 6:00 pm

Saturday 9:00 am - 12:00 pm

Contact Information

A: 5500 Dixie Highway Saginaw, MI 48601

P: 989.777.1661

Saginaw - Fashion Square Mall | Independent Bank

Branch LocationContact Information

A: 4850 Bay Road Saginaw, MI 48604

P: 989.799.0070

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Sunday - closed

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 6:00 pm

Saturday 9:00 am - 12:00 pm

Sunday - closed

Saginaw - State St. | Independent Bank

Branch LocationContact Information

A: 3601 State St. Saginaw, MI 48602

P: 989.799.0720

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Saturday - closed

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 6:00 pm

Saturday 9:00 am - 12:00 pm

Saginaw Mortgage Loan Center | Independent Bank

Mortgage & Loan CenterContact Information

A: 5580 State St Suite 5 Saginaw MI 48603

P: 989-799-3159

By Appointment Only

Sand Lake | Independent Bank

Branch LocationContact Information

A: 5 S 3rd St. Sand Lake MI 49343

P: 616.636.8881

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 4:30 pm

Saturday - closed

Drive-Up

Monday - Friday 9:00 am - 5:0 pm

Saturday 9:00 am - 12:00 pm

Saranac | Independent Bank

Branch LocationContact Information

A: 29 Church Street Saranac, MI 48881

P: 616.642.9406

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 4:30 pm

Saturday - closed

Drive-Up

Monday - Friday 9:00 am - 4:30 pm

Saturday 9:00 am - 12:00 pm

Sebewaing | Independent Bank

Branch LocationContact Information

A: 8880 Unionville Road Sebewaing, MI 48759

P: 989.883.3310

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Saturday - closed

Drive-Up

Monday - Thursday 8:30 am - 5:00 pm

Friday 8:30 am - 6:00 pm

Saturday 9:00 am - 12:00 pm

Shelby Township | Independent Bank

Branch LocationContact Information

A: 49785 Van Dyke Ave. Shelby Township, MI 48317

P: 586.731.6130

Office

Monday - Friday 9:00 am - 4:30 pm

Saturday 9:00 am - 12:00 pm

Drive-Up

Monday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

South Haven Mortgage Loan Center | Independent Bank

Mortgage & Loan CenterContact Information

A: 250 Broadway St South Haven MI 49090

P: 269-569-7254

Sparta | Independent Bank

Branch LocationContact Information

A: 525 S. State St. Sparta, MI 49345

P: 616.887.8277

Office

Monday - Friday 9:00 am - 5:00 pm

Saturday - closed

Drive-Up

Monday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Standish | Independent Bank

Branch LocationContact Information

A: 209 S. Main St. Standish, MI 48658

P: 989.846.4595

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Drive-Up

Monday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Suttons Bay | Independent Bank

Branch LocationContact Information

A: 93 W. Fourth St., Suite D Suttons Bay, MI 49682

P: 231.995.5565

Office

Monday - Friday 9:00 am - 5:00 pm

Drive-Up

Monday - Friday 9:00 am - 5:00 pm

Traverse City - Copper Ridge | Independent Bank

Branch LocationContact Information

A: 4011 Eastern Sky Dr. Traverse City, MI 49684

P: 231.995.5540

Office

Monday - Thursday 9:00 am - 4:30 pm

Friday 9:00 am - 5:00 pm

Drive-Up

Monday - Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 5:30 pm

Saturday 9:00 am - 12:00 pm

Traverse City - Downtown | Independent Bank

Branch LocationContact Information

A: 333 W. Grandview Parkway Traverse City, MI 49684

P: 231.995.5508

Traverse City - Garfield | Independent Bank

Branch LocationContact Information

A: 1239 S. Garfield Traverse City, MI 49686

P: 231.995.5575

Office

Monday - Friday 9:00 am - 4:30 pm

Drive-Up

Monday - Friday 9:00 am - 5:00 pm

Troy - Columbia Center | Independent Bank

Branch LocationContact Information

A: 201 W. Big Beaver Road Troy, MI 48084

P: 248.689.1200

Office

Monday - Friday 9:00 am - 5:00 pm

Drive-Up

Monday - Friday 9:00 am - 5:00 pm

Troy Mortgage Loan Center | Independent Bank

Mortgage & Loan CenterContact Information

A: 201 W. Big Beaver Rd., Suite 201 Troy, MI 48084

P: 248.918.5690

Office

Monday - Friday 9:00 am - 5:00 pm

Contact Information

A: 6586 Center St. Unionville, MI 48767

24 Hour ATM Service

Contact Information

A: 194 Main St. Vermontville, MI 49096

24 Hour ATM Service

White Cloud | Independent Bank

Branch LocationContact Information

A: 1075 Wilcox Ave. White Cloud, MI 49349

P: 231.689.6608

Office

Monday - Friday 9:00 am - 4:00 pm

Saturday 9:00 am - 12:00 pm

Drive-Up

Monday - Friday 9:00 am - 4:30 pm

Saturday 9:00 am - 12:00 pm

Williamston | Independent Bank

Branch LocationContact Information

A: 1245 E. Grand River Road Williamston, MI 48895

P: 517.655.2168

Office

Monday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Drive-Up

Monday - Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Zeeland Mortgage Loan Center | Independent Bank

Mortgage & Loan CenterContact Information

A: 109 E Main St Zeeland MI 49464

P: 616.836.9261

By Appointment Only