Streamline Your Finances with ONE Wallet

Take Your Digital Banking Experience to the Next Level

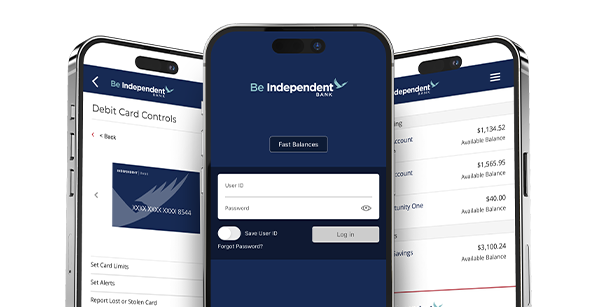

Manage Accounts

View all of your accounts, transactions, and account history in our easy-to-use dashboard.

Move Your Money

Transfer funds between Independent Bank accounts, send money to other banks with external transfers, or pay friends and family instantly with Zelle.®

Pay Bills

Pay bills securely from anywhere, anytime. Schedule one-time or recurring payments, track due dates, and avoid late fees—all in one place.

Mobile Deposit

Skip a trip to the bank and deposit checks right from your phone.

Debit Card Controls

Manage your Debit Mastercard® by setting spending limits, usage preferences, and geographic restrictions.

Credit Score

Check your free credit score, get helpful tips, and view your full credit report anytime, without impacting your score.

ONE Account Swipe Tracker*

Keep tabs on your debit card usage with Swipe Stats. Track your monthly swipes and see how close you are to reaching the next interest tier—the more you swipe, the more you earn!

Go Paperless

Sign up for eStatements, eNotices, and eTax Forms to reduce clutter and enhance security.

ONE Wallet FAQs

Answers to Common Questions About ONE Wallet Digital Banking

How do I enroll in eStatements?

How do I transfer money to someone else?

How can I send money to myself?

Why am I seeing two different balances?

How do I make a mobile deposit?

If I only have a loan, can I still enroll in ONE Wallet digital banking?

Are my tax documents accessible online?

Get More From Your Digital Banking Experience

Pay bills on time from the convenience of ONE Wallet digital banking.

Skip a trip to the bank and deposit checks from your phone via ONE Wallet digital banking.

Send and receive money from those you trust in minutes.

Stay on top of your finances with account info sent to your phone.

*The total number of swipes is counted for each statement cycle.