Get Out & Go

Auto Loans That Put You in the Driver's Seat

Hit the road with a new or used auto loan from Independent Bank. You may be able to get behind the wheel sooner than you think!

Why Work With Independent Bank for Your Auto Loan?

Competitive Rates

Our auto loans come with competitive interest rates and quick approvals, so you can hit the road without delay.

Flexible Terms

With terms up to 84 months, choose the repayment option that align with your financial plans.

Digital Closing

Close your loan anytime and anywhere with easy signing from your phone or computer.

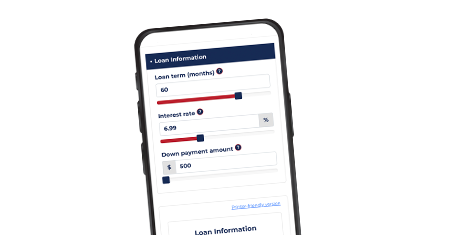

Map Out Your Next Move

Explore tools to plan payments and find the best fit for your goals.

Current Rates**

Auto Loan FAQs

Answers to Common Questions About Auto Loans

What credit score do I need to qualify for an auto loan?

At Independent Bank, our auto loan options cater to a variety of credit scores. While a higher score can help you secure better interest rates, we offer competitive rates for borrowers across all credit ranges, ensuring that everyone who qualifies has the opportunity to drive their dream car.

What are your loan terms for an auto loan?

Auto loan terms typically range from 24 to 84 months. Shorter terms usually come with lower interest rates but higher monthly payments, while longer terms may offer lower payments with more interest over time.

How do interest rates affect my auto loan at Independent Bank?

Interest rates at Independent Bank play a crucial role in determining your overall loan cost. Lower rates mean less money paid over the life of the loan, resulting in lower monthly payments. Our competitive rates are designed to help you save more, making it easier for you to afford the vehicle you desire.

Can I get preapproved for an auto loan?

Yes! At Independent Bank, you can get pre-approved for an auto loan to help streamline your vehicle shopping experience. Pre-approval provides you with a clear understanding of how much you can borrow and the rates available, allowing you to confidently shop for your next vehicle.

What is the difference between a new and used car loan?

New car loans generally have lower interest rates than used car loans. However, used car loans are often smaller in amount because used vehicles typically cost less.

Can I refinance my current auto loan?

Yes, refinancing may allow you to replace your current loan with a new one, often with a better interest rate or different loan term. This can help lower your monthly payments or reduce the overall cost of the loan. In addition to a refinance of your current auto loan, you may also be eligible to obtain a cash out for other purposes.

** Standard consumer loan underwriting guidelines apply. Annual Percentage Rate (APR). Rate available for well-qualified borrowers. Your rates may vary depending on your specific credit profile.