Personal Loans That Fit Your Life

Whether you’re consolidating debt, covering unexpected expenses, or making a big purchase, Independent Bank offers the flexibility you need to achieve your goals.

Wherever Life Takes You

We offer personal loans that can get you where you want to go.

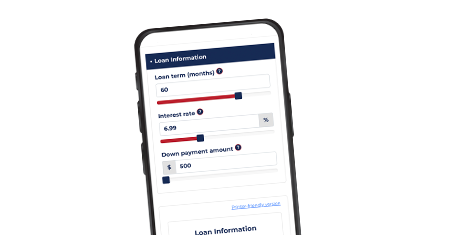

Calculate Your Payment

Run the numbers and discover what works best for your budget with our free financial calculators.

Current Rates**

Personal Loan FAQs

Answers to Common Questions About Personal Loans

What information do I need to provide when applying for a personal loan?

You typically need to provide identification, proof of income, employment details, and information about your debts and assets.

What factors affect my eligibility for a personal loan?

Eligibility for a personal loan depends on factors such as your credit score, income, existing debt, and employment history.

How does a personal line of credit differ from a personal term loan?

A line of credit offers the ability to re-advance on the loan, up to a specified credit limit. Both your interest rate and payment amount in our personal line of credit are variable. That contrasts with our personal term loans, which provide funds only at the point you first receive the loan and include a fixed rate and payment amount.

Do personal loan payments include interest and principal?

Yes, term loan payments generally include both principal and interest. Initially, a larger portion of each payment goes toward interest, but over time, more goes toward the principal.

Will my monthly payment stay the same throughout the loan term?

For fixed-rate personal loans, your monthly payment typically stays the same throughout the loan term. Variable-rate loans may have fluctuating payments.

Make A HELOC Deposit

Visit our online HELOC Advance Deposit Payment Center today.

**Standard consumer loan underwriting guidelines apply. Annual Percentage Rate (APR). Rate available for well-qualified borrowers. Your rates may vary depending on your specific credit profile.