Put Your Home’s Equity to Work with Flexible Lending Options

Choose the Right Home Equity Solution

Home Equity Line of Credit

- Variable Rate

- Great for Ongoing Projects or Expenses

- Withdraw Funds as Needed

- Flexible Payments During Draw Period

- Payments May Vary with Rate Changes

- Pay Interest Only on What You Borrow

- Secured by Your Home

Home Equity Loan

- Fixed & Variable Rates

- One-time Large Expenses

- Full amount Disbursed Upfront

- Fixed or Variable Monthly Payments

- Payment Applies to Full Loan Amount

- Payment Includes Principal & Interest

- Secured by Your Home

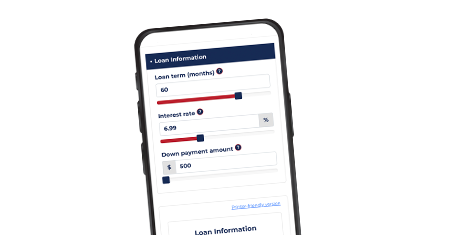

Home Equity Calculators

See how home equity could work for you with our free calculators — from estimating your equity to planning payments.

Current Rates*

Home Equity Loan FAQs

Answers to Common Questions About Home Equity Loans

What’s the difference between a HELOC and a Home Equity Loan?

Which option is better for home renovations?

Do HELOCs and Home Equity Loans have different interest rates?

Yes, HELOCs have variable interest rates that can change over time. Home Equity Installment Loans have the option to have either a fixed or variable rate.

Can I use a HELOC or Home Equity Loan for things other than home improvements?

*Standard consumer loan Home Equity Line of Credit (HELOC) underwriting guidelines apply. Annual Percentage Rate (APR). Rate available for well-qualified borrowers. Your HELOC rates may vary depending on your specific credit profile. Your HELOC rates are variable and subject to change monthly. Your HELOC ate will be based on the then-current index and margin. Loan-To-Value: Total of first and second mortgage balances and commitments divided by the value of the real estate pledged. Home equity lines of credit are available for homes located in Michigan or Ohio