Personal Checking That Fits Your Life

From everyday banking to premium features, Independent Bank has a checking account designed for you.

Find the Right Checking Account for You

.png)

ONE Account

Earn up to 5.00% APY1

- No monthly service fees with eStatements2

- Free ONE Wallet digital banking

- No minimum balance required

- 32,000+ fee-free MoneyPass® ATMs nationwide

- Several overdraft service options

- Get up to $500 annually when you use your debit card3

Opportunity ONE

No Overdraft Fees

- No monthly service fees with eStatements2

- Free ONE Wallet digital banking

- No minimum balance required

- 32,000+ fee-free MoneyPass® ATMs nationwide

Earn up to $350* When You Open a New Checking Account

New customers have the opportunity to Earn $350 when you receive direct deposits of $500 or more within 90 calendar days of account opening.

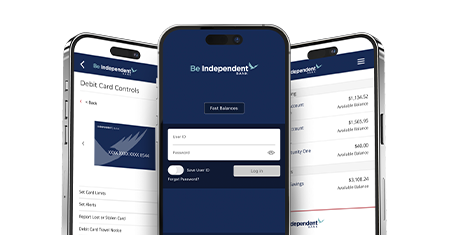

Manage Your Money with ONE Wallet Digital Banking

Personal Checking FAQs

Answers to your Common Questions about Checking Accounts.

What do I need to open a checking account?

Are there any fees for checking accounts?

Can I access my account online?

What security features are included?

Key Features of Our Checking Accounts

Skip a trip to the bank and deposit checks from your phone via ONE Wallet.

Check your free credit score, get helpful tips, and view your full credit report anytime, without impacting your score.

Send and receive money from those you trust in minutes.

We waive your fees at over 32,000 MoneyPass ATMs nationwide.

1 Annual Percentage Yield (APY). Rate based on monthly volume of debit card swipes. Rate subject to change without notice.

2 If eStatements are not selected, a $3/month fee will be assessed for paper statements. Fee may reduce earnings.

3 Up to $500 example based upon an average daily balance of $10,000 and 46 or more debit card swipes each statement period. Interest of 0.10% APY will be paid on balances over $10,000.01.

$10 minimum deposit is required for all accounts at account opening. Accounts are subject to standard account opening guidelines. Other fees and restrictions may apply.

* Offer begins January 1, 2026 and is valid through March 31, 2027, and may be extended, modified, or discontinued at any time. Subject to 1099-INT reporting. To receive the $350 bonus, you must open a new ONE or Opportunity ONE Account and receive direct deposits totaling $500 or more within 90 calendar days of account opening. Limit one bonus per customer. Account must be in good standing to receive the bonus. Bonus will be paid out within 90 calendar days within meeting the requirements.