The Simplicity of the ONE Account

Earn $350* When You Open a New ONE Account

New customers have the opportunity to Earn $350 when you receive direct deposits of $500 or more within 90 calendar days of account opening.

Why Choose the ONE Account for Your Checking Account?

Earn up to 5.00% APY**

No Fees

No monthly maintenance fee when enrolled in eStatements.1

Switching is Simple

Moving your direct deposit to your new checking account is a breeze with our Switch Kit.

Checking + Savings in ONE

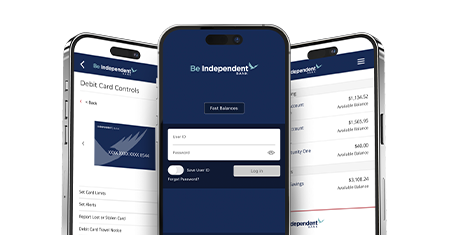

Manage Your Money with ONE Wallet Digital Banking

ONE Account FAQs

Answers to common questions about the ONE Account.

How can I waive the monthly maintenance fee?

Does the ONE Account earn interest?

Can I access the ONE Account online?

Is there a limit to the number of withdrawals I can make?

Is this account insured by the FDIC?

Yes, this account is FDIC insured — for details on what types of accounts and balances are covered, please visit fdic.gov.

Calculate your specific limits at: edie.fdic.gov.

The More You Swipe, The More You Earn^

Using your Independent Bank Debit Mastercard for everyday purchases really adds up.

| Number of Transactions | Rate | APY | Effective Date |

|---|---|---|---|

|

{name='number_of_transactions', label=Number of Transactions, type=TEXT, id=2, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

0-10

|

{name='rate', label=Rate, type=TEXT, id=3, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

0.01%

|

{name='apy', label=APY, type=TEXT, id=4, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

0.01%

|

{name='effective_date', label=Effective Date, type=DATE, id=6, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

February 18, 2026

|

|

{name='number_of_transactions', label=Number of Transactions, type=TEXT, id=2, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

11-20

|

{name='rate', label=Rate, type=TEXT, id=3, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

0.25%

|

{name='apy', label=APY, type=TEXT, id=4, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

0.25%

|

{name='effective_date', label=Effective Date, type=DATE, id=6, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

February 18, 2026

|

|

{name='number_of_transactions', label=Number of Transactions, type=TEXT, id=2, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

21-30

|

{name='rate', label=Rate, type=TEXT, id=3, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

0.75%

|

{name='apy', label=APY, type=TEXT, id=4, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

0.75%

|

{name='effective_date', label=Effective Date, type=DATE, id=6, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

February 18, 2026

|

|

{name='number_of_transactions', label=Number of Transactions, type=TEXT, id=2, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

31-45

|

{name='rate', label=Rate, type=TEXT, id=3, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

1.50%

|

{name='apy', label=APY, type=TEXT, id=4, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

1.51%

|

{name='effective_date', label=Effective Date, type=DATE, id=6, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

February 18, 2026

|

|

{name='number_of_transactions', label=Number of Transactions, type=TEXT, id=2, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

46+

|

{name='rate', label=Rate, type=TEXT, id=3, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

4.89%

|

{name='apy', label=APY, type=TEXT, id=4, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

5.00%

|

{name='effective_date', label=Effective Date, type=DATE, id=6, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

February 18, 2026

|

|

{name='number_of_transactions', label=Number of Transactions, type=TEXT, id=2, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

Balances over $10,000 will earn 0.10%

|

{name='rate', label=Rate, type=TEXT, id=3, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

N/A

|

{name='apy', label=APY, type=TEXT, id=4, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

N/A

|

{name='effective_date', label=Effective Date, type=DATE, id=6, deleted=false, options=[], maxNumberOfOptions=2147483647, maxNumberOfCharacters=2147483647, inlineHelpText=null, foreignTableId=0, foreignColumnId=0, foreignTableName=null, foreignColumnName=null, foreignColumnType=null, width=null, isHubspotDefined=false, fileType=null, isArray=false, codeType=OTHER, arrayCountLimits=nulldisplayType=null, hiddenForPublicApi=false}

February 18, 2026

|

Take Your Bank Account to the Next Level

Access your accounts on the go in ONE Wallet from your phone, computer, or tablet.

Enjoy easy access to your funds as well as a variety of Debit Mastercard® benefits.

Free Credit Monitoring

Check your free credit score, get helpful tips, and view your full credit report anytime, without impacting your score.

* Offer begins January 1, 2026 and is valid through March 31, 2027, and may be extended, modified, or discontinued at any time. Subject to 1099-INT reporting. To receive the $350 bonus, you must open a new ONE or Opportunity ONE Account and receive direct deposits totaling $500 or more within 90 calendar days of account opening. Limit one bonus per customer. Account must be in good standing to receive the bonus. Bonus will be paid out within 90 calendar days within meeting the requirements. Offer valid for new checking account customers only. Subject to standard account opening guidelines

** Annual Percentage Yield (APY). Rate based on monthly volume of debit card swipes. Rate subject to change without notice.

*** Up to $500 example based upon an average daily balance of $10,000 and 46 or more debit card swipes each statement period. Interest of 0.10% APY will be paid on balances over $10,000.01.

1 If eStatements are not selected, a $3/month fee will be assessed for paper statements. Fee may reduce earnings. $10 minimum deposit is required for all accounts at account opening. Accounts are subject to standard account opening guidelines. Other fees and restrictions may apply.

^The total number of swipes is counted for each statement cycle.